Top Mobile Home Insurance Companies 2025

Top Mobile Home Insurance Providers for 2025

Finding the right mobile home insurance can be challenging, but with the right guidance, you can secure a policy that meets your needs. As we enter 2025, several companies are distinguishing themselves with outstanding coverage and customer service. Let’s delve into some of the leading mobile home insurance providers this year.

State Farm is a top choice, celebrated for its comprehensive coverage and personalized service. They offer a range of plans that cater to the specific needs of mobile homeowners, from basic protection to extensive coverage. Their intuitive app simplifies policy management, making it easy to file claims and access details.

Another strong contender is Allstate, renowned for its reliability and customer satisfaction. Allstate’s policies cover everything from structural damage to personal belongings, and they offer discounts like multi-policy and protective device discounts, which can lower premium costs significantly. This makes Allstate ideal for those seeking savings without sacrificing coverage.

Progressive is also making waves in 2025 with its flexible coverage options and competitive pricing. Known for innovation, Progressive allows policy customization to include additional protections such as water backup and identity theft coverage, ensuring you only pay for what you need.

When selecting a mobile home insurance provider, consider:

- Comprehensive Coverage: Ensure policies cover a broad range of risks.

- Affordable Premiums: Compare quotes to find budget-friendly plans.

- Customer Service: Choose companies with high satisfaction ratings.

By evaluating these factors, you can find a provider that not only safeguards your investment but also offers peace of mind. These companies are at the forefront of delivering reliable and affordable coverage for mobile homeowners in 2025.

Comparing Coverage Options for Mobile Homes

Choosing the right insurance company for your mobile home is essential, especially in 2025, where several companies excel in providing comprehensive coverage and customer satisfaction. Understanding the various coverage options is crucial to ensure your mobile home is adequately protected against risks like natural disasters and theft.

Key Coverage Options

Mobile home insurance typically includes several types of coverage:

- Dwelling Coverage: Protects the structure of your mobile home from damage due to events like fires or storms.

- Personal Property Coverage: Safeguards your belongings, such as furniture and electronics, inside the home.

- Liability Protection: Provides financial protection if someone is injured on your property.

- Additional Living Expenses: Covers costs if you need to live elsewhere while your home undergoes repairs.

Practical Examples

Imagine a storm damaging your mobile home. Companies like State Farm or Allstate, known for their comprehensive dwelling coverage, can ensure repairs are conducted promptly, minimizing life disruptions. Similarly, if a guest is injured on your property, liability protection from insurers like Progressive can cover medical expenses, preventing unexpected financial burdens.

Selecting the Best Insurer

When choosing an insurance provider, consider factors such as customer service, claim handling, and policy flexibility. Reading reviews and comparing quotes can offer valuable insights. Companies like GEICO and Nationwide are renowned for their responsive customer service and competitive rates, making them favored choices among mobile homeowners.

By understanding your coverage needs and researching top insurers, you can secure a policy that provides peace of mind and financial security for your mobile home.

Affordable Mobile Home Insurance Plans

Navigating the world of mobile home insurance can seem complex, but it doesn’t have to be. In 2025, several companies offer affordable and comprehensive plans tailored to the unique needs of mobile homeowners. These options ensure you get the necessary coverage without straining your budget.

Why Choose Affordable Mobile Home Insurance?

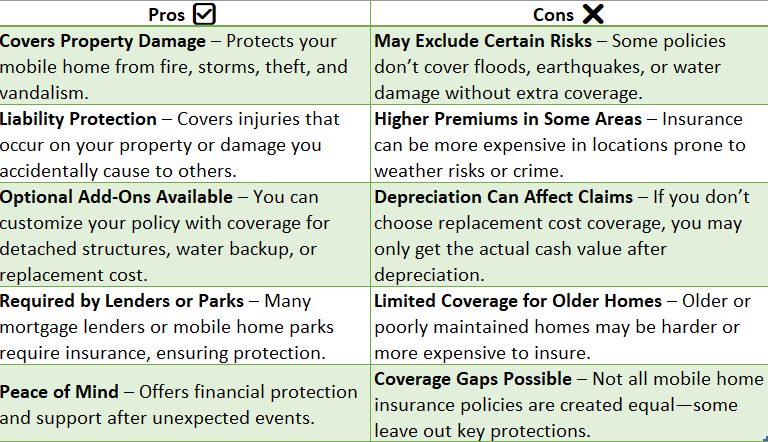

Mobile homes offer flexibility and affordability but also come with specific risks. From natural disasters to theft, having the right insurance is crucial. Affordable plans not only save money but also provide peace of mind, knowing you’re protected against unforeseen events. Key benefits include:

- Cost-Effective Coverage: Protection without overspending.

- Customizable Options: Policies tailored to your needs and budget.

- Comprehensive Protection: Coverage against risks like fire, theft, and weather-related damages.

Top Picks for 2025

- SecureHome Insurance: Offers competitive rates and excellent customer service, with customizable plans covering everything from structural damage to personal belongings.

- SafeNest Assurance: Focuses on affordability and reliability, providing budget-friendly and robust policies with an easy-to-use online platform.

- Guardian Shield: Known for its innovative approach, offering discounts for safety features and bundling options, making it a favorite among cost-conscious homeowners.

Choosing the right mobile home insurance doesn’t have to be overwhelming. By considering these top companies, you can find a plan that offers both affordability and peace of mind, ensuring your home is well-protected for years to come.

Customer Satisfaction in Mobile Home Insurance

Choosing the best mobile home insurance in 2025 hinges significantly on customer satisfaction. A policy’s true value lies in the quality of support and service it offers. Mobile homeowners frequently emphasize the importance of responsive customer service and comprehensive coverage.

Searching for affordable auto insurance? Head over to InsuranceShoppingto compare quotes and save on your policy! Have questions? Call us at 833-211-3817 for immediate assistance!

Why Customer Satisfaction Matters:

- Peace of Mind: Assurance that your insurer will be there when needed is priceless, especially from companies with a strong track record in efficient claim handling.

- Trustworthy Relationships: Establishing a rapport with your insurer can ease the claims process, reducing stress. Insurers that prioritize customer satisfaction often build long-lasting relationships with their clients.

- Tailored Solutions: Insurers attentive to customer needs are more likely to offer policies that suit individual circumstances, avoiding unnecessary coverage costs.

A recent survey highlighted companies like SecureHome Insurance and SafeGuard Mobile as leaders in customer satisfaction. SecureHome was praised for its quick response times and personalized service, while SafeGuard Mobile received accolades for its transparent policy terms and proactive customer support.

Ultimately, when selecting a mobile home insurance provider, it’s essential to consider not just the cost but also the quality of service. Companies that prioritize customer satisfaction tend to offer more reliable and supportive experiences, ensuring comprehensive protection for your mobile home in any situation.

Mobile Home Insurance Discounts and Savings

Securing your mobile home with the right insurance policy is essential, but you can also save money while ensuring protection. The top mobile home insurance companies of 2025 offer various discounts that can significantly lower your premium costs. Here’s how you can take advantage of these savings opportunities.

Bundling Discounts: By combining your mobile home insurance with other policies like auto or life insurance, you can receive substantial discounts. This approach not only simplifies managing your insurance but also maximizes savings.

Safety and Security Discounts: Installing safety features such as smoke detectors, burglar alarms, and fire extinguishers can lead to premium discounts. Insurers appreciate these proactive measures that reduce risk and often reward policyholders who invest in safety enhancements.

Loyalty Discounts: Remaining with the same insurance provider over time can earn you loyalty discounts. Companies value long-term customers and often offer reduced rates as a token of appreciation for continued business.

Claims-Free Discounts: A history of not filing claims can make you eligible for a claims-free discount. This incentive encourages homeowners to maintain their property and avoid unnecessary claims, benefiting both the insurer and the insured.

Understanding and utilizing these discounts can make your mobile home insurance more affordable without compromising coverage. Discuss these options with your insurance agent to ensure you’re getting the best deal possible. A little research and proactive planning can lead to significant savings on your mobile home insurance policy.

Understanding Mobile Home Insurance Policies

Mobile home insurance is essential for safeguarding your investment against the unique risks associated with mobile or manufactured homes. Understanding these policies can significantly impact your financial security and peace of mind. When selecting a policy, it’s important to consider your home’s specific needs and your lifestyle. For instance, if you reside in an area susceptible to natural disasters, ensure your policy includes coverage for events like floods or earthquakes.

Key benefits of a comprehensive mobile home insurance policy include:

- Dwelling Coverage: Protects your home’s structure from damage due to covered perils.

- Personal Property Coverage: Safeguards personal belongings within your home.

- Liability Protection: Provides financial protection if someone is injured on your property.

- Additional Living Expenses: Covers costs if you need temporary housing due to home damage.

Real-world scenarios underscore the importance of adequate coverage. Take, for example, a family in Florida whose mobile home was damaged by a hurricane. Their insurance not only covered repair costs but also provided temporary housing, proving invaluable during a stressful period.

When assessing the best mobile home insurance companies of 2025, prioritize providers offering customizable policies, excellent customer service, and competitive rates. This approach ensures your mobile home is well-protected, allowing you to enjoy your home with confidence.

How to Choose the Right Mobile Home Insurance

Choosing the right mobile home insurance doesn’t have to be overwhelming. By focusing on a few key factors, you can secure a policy that offers both protection and peace of mind. Here’s how to navigate the process effectively.

Start by assessing your coverage needs. Mobile homes face specific risks, so it’s essential to identify what you need protection against. For example, if you reside in a disaster-prone area, ensure your policy covers events like floods or earthquakes. Consider Jane’s experience in Florida; her comprehensive hurricane coverage saved her significant repair costs after a storm.

When evaluating policies, look beyond just the cost. While affordability matters, the cheapest policy might not provide adequate protection. Pay attention to the insurer’s reputation, customer service quality, and the efficiency of their claims process. A company known for quick and fair claims handling can be invaluable during emergencies.

- Reputation and Reviews: Research online reviews to understand customer satisfaction levels.

- Claims Process: Prioritize insurers with a track record of efficient claims handling.

- Discounts and Bundles: Explore potential savings by bundling your mobile home insurance with other policies, such as auto insurance.

Lastly, consult with an insurance agent. They can offer tailored advice and clarify any policy details. By following these steps, you can confidently select a mobile home insurance policy that safeguards your investment and provides peace of mind.

Mobile Home Insurance Claims Process Explained

Understanding the mobile home insurance claims process can significantly ease the stress of dealing with damage from storms or accidents. Here’s a streamlined guide to help you manage claims confidently.

Immediate Actions Post-Incident: Ensure everyone’s safety first, and if needed, contact emergency services. Document the damage thoroughly with photos and videos, as this will be crucial for your claim. Take steps to prevent further damage, like covering broken windows or tarping a damaged roof.

Contact Your Insurance Provider: Report the incident to your insurer promptly, using their 24/7 claims hotline if available. Be prepared to provide detailed information about the incident, including the date, time, and nature of the damage.

Claims Assessment and Adjustment: Expect a visit from a claims adjuster to assess the damage and estimate repair costs. This assessment is vital for determining your payout. Review the adjuster’s estimate carefully, and if you disagree, discuss it with your insurer to reach a satisfactory resolution.

Settlement and Repairs: Once you agree on the settlement, you’ll receive payment, either by direct deposit or check, to cover repair costs. Use these funds to hire reputable contractors to restore your mobile home, and keep all receipts and documentation for future reference.

By following these steps, you can navigate the claims process more smoothly. Staying organized and maintaining clear communication with your insurance provider are key to ensuring your mobile home is restored efficiently.

Take the next step toward affordable coverage. Visit NewAutoInsurance and get instant quotes that fit your budget and driving needs. If you’d like to speak with a representative, call us at 833-211-3817!

Explore InsuranceShopping to find a wide range of insurance options tailored to your needs.