Finding the Best Health Insurance for Expats in 2026

Secure your life abroad with comprehensive global health coverage. Learn how to choose the best health insurance for expats to avoid financial risk.

Finding the Best Health Insurance for Expats Living Abroad

Secure comprehensive global medical coverage that provides access to private hospitals and direct billing. Find the best health insurance for expats to protect your finances and health abroad.

Finding the Best Health Insurance in New York for 2026

Learn how to evaluate plans and secure the best health insurance in New York based on cost, network, and your personal needs. Get key tips for 2026 enrollment.

Understanding the 7 Stages of Alzheimer’s Disease Progression

This guide details the seven stages of Alzheimer's disease to help families anticipate care needs and make informed legal, financial, and caregiving decisions.

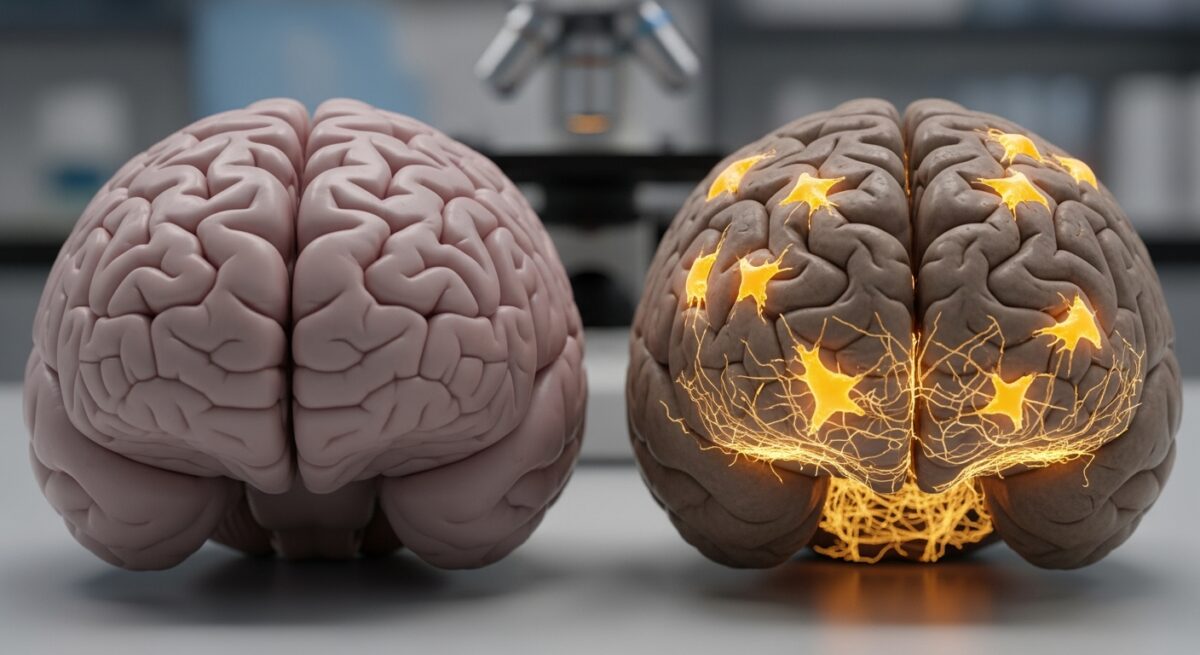

Understanding Alzheimer’s Disease: A Guide to Its Causes and Risk Factors

This guide explains the complex biological causes and key risk factors for Alzheimer's disease, helping you understand current scientific knowledge.

Alzheimer’s Disease Symptoms: Early Signs and Progression

Learn to recognize the early warning signs of Alzheimer's disease symptoms and understand how they differ from normal aging patterns for timely intervention.

Defining Alzheimer’s: Understanding Its Nature as a Disease

Alzheimer's is definitively a progressive brain disease, not normal aging. Understanding this distinction is key to seeking diagnosis, care, and support.

Alzheimers Disease Treatment Options and Future Directions

Explore current and emerging Alzheimer's disease treatment options, from symptom management to new disease-modifying therapies. Learn to build a comprehensive care plan.

10 Key Alzheimer’s Disease Symptoms and Early Warning Signs

Learn the 10 key symptoms and early warning signs of Alzheimer's disease to enable timely diagnosis and future care planning for yourself or a loved one.

What Is Alzheimer’s Disease? Understanding Its Causes and Symptoms

This guide explains what Alzheimer's disease is, detailing its biological causes, progressive symptoms, and current management strategies to help families plan effectively.

What Determines Your Medicare Supplement Insurance Cost?

Your Medicare supplement insurance cost is shaped by age, location, and plan type. Learn the key factors and strategies to find an affordable premium that fits your budget.

How to Become a Medicare Insurance Agent: A Clear Career Path

Launch a stable, rewarding career by learning how to become a Medicare insurance agent, helping seniors navigate complex healthcare choices.